The Single Strategy To Use For Bankruptcy Melbourne

Table of ContentsSome Known Incorrect Statements About Insolvency Melbourne Not known Facts About Insolvency MelbourneExamine This Report about Bankruptcy AustraliaGetting The Insolvency Melbourne To WorkMore About Bankrupt Melbourne

As Kibler said, a business needs to have a truly excellent factor to reorganize a good factor to exist as well as the rise of shopping has made stores with large store existences obsolete. 2nd possibilities might be a precious American perfect, but so is advancement and the growing discomforts that come with it.Are you gazing down the barrel of stating on your own insolvent in Australia? This is no justification for somebody leading you down the path of declaring personal bankruptcy.

We recognize that every person faces monetary stress at some factor in their lives. In Australia, also households as well as organizations that seem to be growing can experience unforeseen hardship due to life changes, job loss, or elements that are out of our control. That's why, below at Leave Financial Obligation Today, we offer you skilled suggestions and also appointments regarding the true consequences of personal bankruptcy, financial debt arrangements as well as other financial problems - we desire you to obtain back on your feet as well as stay there with the most effective feasible result for your future as well as all that you want to acquire.

Not known Facts About Bankruptcy Advice Melbourne

It deserves noting that when it comes to debt in Australia you are not the only one. Personal insolvencies and also bankruptcies are at a document high in Australia, influencing three times as numerous Australian compared to twenty years back. There is, nevertheless, no safety in numbers when it comes to proclaiming insolvency and bankruptcy.

One thing that lots of Australian individuals are unaware of is that in real truth you will be detailed on the Australian NPII for merely lodging an application for a financial debt arrangement - Insolvency Melbourne. Lodging a financial debt agreement is really an act of stating on your own bankrupt. This is an official act of insolvency in the eyes of Australian law also if your financial obligation enthusiasts do decline it.

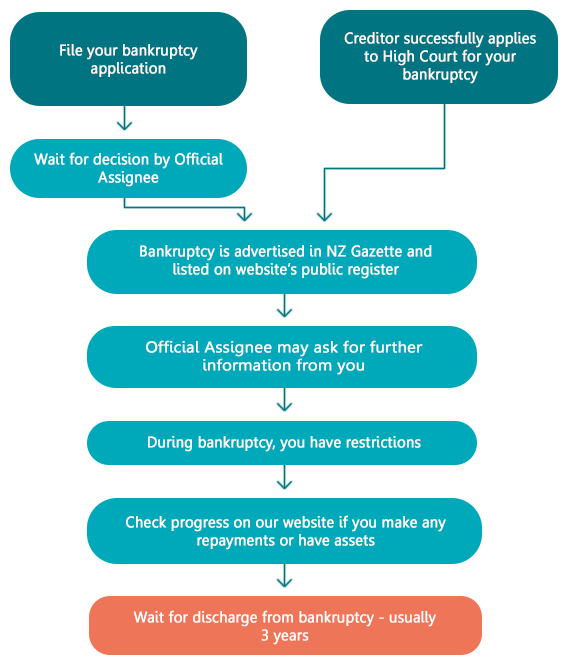

Throughout as well as after your personal bankruptcy in Australia, you have particular responsibilities and also encounter specific restrictions. Any type of financial institutions who are wanting to obtain a duplicate of your credit record can request this information from a credit score reporting firm. Once you are stated bankrupt safeguarded creditors, who hold safety and security over your property, will likely be qualified to take the property and also sell it.

An Unbiased View of Personal Insolvency

a home or vehicle) As soon as stated bankrupt you have to notify the trustee promptly if you become the recipient of a departed estate If any one of your lenders hold legitimate safety and security over any kind of home and also they do something about it to recuperate it, you have to help You must surrender your ticket to the trustee if you are asked to do so You will certainly remain liable for financial obligations sustained after the day of your bankruptcy You will will not have the ability to work as a director or manager of a company without the courts approval As you can see entering right into personal bankruptcy can have long-term unfavorable impacts on your life.

Entering into personal bankruptcy can leave your life in tatters, shedding your home and also ownerships and also leaving you with absolutely nothing. Prevent this end result by speaking to a debt counsellor today about taking a different rout. Personal bankruptcy requires to be correctly considered and also intended, you must not ever before get in personal bankruptcy on a whim as it can take on you that you may not even know. Liquidation Melbourne.

We provide you the capability to pay your financial debt off at a decreased price and with reduced passion. We recognize what creditors are looking for and also are able to work out with them to give you the best chance to settle your financial obligations.

The Single Strategy To Use For Bankruptcy

What is the distinction between default as well as personal bankruptcy? Skipping on a financing implies that you've broken the promissory or cardholder contract with the loan provider to make settlements promptly. Each lending institution has its very own demands surrounding the amount of missed settlements you can have before it considers you in default. In some cases, that may be as little as one missed out on repayment or it can be as many as 9 missed out on payments.

8 Easy Facts About Bankruptcy Australia Described

If you skip on an auto financing, the loan provider will commonly attempt to retrieve the vehicle. Unsafe financial obligation, like bank card financial obligation, has no security; in these cases, it's tougher for a debt collector to redeem the debt, but the firm may still Bankruptcy Melbourne take you to court as well as effort to position a lien on your home or garnish your incomes.

The court will certainly assign a trustee that might sell off or market several of your belongings to pay your lenders. While the majority of your financial debt will certainly be terminated, you could pick to pay some financial institutions in order to maintain an automobile or house on which the financial institution has a lien, says Ross (Bankruptcy).

If you function in a market where employers check your credit rating as part of the hiring procedure, it might be extra tough to obtain a brand-new task or be advertised after insolvency. Jay Fleischman of Money Wise Regulation claims that if you have bank card, they will certainly usually be shut as soon as you apply for insolvency.